Tuesday, October 28, 2008

Sponsorship Overview

Reasons for sports sponsorship:

· Strengthen customer relationships

· Acquire new customers

· Portray brand as unique or differentiated, relevant, active, relatable, or similarly related to the company value proposition

· Generate advocacy on a targeted tier of the consumer spending pyramid

· Provide incentives for retail distribution channels

· Create awareness and acceptance

· Correlate brand with goodwill and positive emotions of event

Sponsorship criteria:

1. Brand fit

2. Interest

3. Reach

4. Event credibility

5. Risk

6. Activation & implementation difficulty

7. Control by governing body

Integrated Marketing

1. Central marketing theme

2. Member programs

3. Merchant programs

4. Advertising

5. Promotions

6. PR

7. Athlete relations

8. Partner (team/host city/event) presence

9. Onsite activation

Sunday, September 21, 2008

Competition Between "Traditional" and "Extreme" Sports

Many adventure sports—such as surf competitions, snow boarding, and mountain biking—are geared toward television audiences, since watching these events in a stadium setting is difficult. To compete for television viewers, a league should ramp up the visual thrills of its sport. On-screen score boxes with cartoons can add excitement, while virtual confetti and animated dueling robots are more likely to keep young people interested and engaged.

Visual appeal is not limited to television audiences. In-stadium, a sports league can create thrills by adding special-effects lighting, improved sound systems, and video boards in high-definition. The new cricket league, Twenty20, has gone further, changing uniforms, adding firework displays to the stadium experience, and dressing cheerleaders in sports bras.

Beyond visual appeal, a sports league needs to integrate youth interests and brands to compete against adrenaline-sports. By creating a presence on the Internet or in the world of video games that allows for a high level of interaction, leagues can construct a social milieu that appeals to a media-savvy generation while also branding their sport as “cool.” The NBA’s creation of a headquarters in Second Life is just one example of how a league can use online communities to generate interest.

And, although it’s understandable why some leagues choose large, unglamorous corporate sponsors (i.e. the NHL and Scotiabank, and MLB and Bank of America) these sponsors can put off young viewers. Better sponsorship choices include Sony Playstation and Mountain Dew: the sponsors of kiteboarding, wakeskating, longboarding, and other non-traditional sports.

Finally, adrenaline sports often emphasize style over statistics. For that reason, it’s important for a league to adopt events, stunts, or individual performances outside the scope of regular competition. Consider the slam dunk contest: this NBA competition allows participants a forum for individuality and style. It also appeals to a basketball subculture by showcasing moves and behavior not generally seen on the court. Similarly, all-star games, three-point contests, and field-goal competitions highlight the individual athlete over the team and can help leagues compete with sports that rely on freestyle play, tricks, and an alternative image.

Though a traditional league would benefit from a more exciting and relevant fan experience, it should be wary of upsetting fans who rely on the sport’s history and traditions. To avoid becoming another XFL, a league should court youth viewers without resorting to major format shifts, gratuitous behavior, or iconoclastic rule changes. If a traditional league can adapt to changing interests and technologies without isolating its core fan base, the league can compete with adrenaline-sports and stay relevant to a new generation.

[This post derives from my entrance essay to the Warsaw MBA program, originally written September 2007.]

Monday, August 25, 2008

Sports Book Trailers

I made the above video for a book about football in Alaska. It took only a couple of hours using the Ken Burns effect on iMovie, the simplest video editing program I know of.

Thursday, August 21, 2008

Facebook App -- Fan Page

One of these bright spots is the fan page. Every application has a fan page--those users who are so pleased with the application that they become "fans." Usually this is a relatively minor percentage of overall users. For example, the Michigan St. Football Application has more than 6,000 users, but only 150 fans. Our Olympic Games 2008 application has only 200 users so far, but 44 fans.

Facebook, for all its flaws, allows for some pretty neat data collection. The fan page enables us to run numbers on even a relatively modest sample size, and to come up with some neat findings.

The table to the left, for example, shows the gender and age range of the fans page. It's startling to see that more of our Olympic Games Application fans are women rather than men. And, looking at the ages, 40% are minors.

It would be interesting to compare these numbers with Facebook's overall demographics or the Neilsen rating demographics for the Beijing Olympics on NBC. My guess is these numbers are much closer to the former group than the latter.

In an unrelated surprise: the 44 fans of the application aren't just Americans. There are users from Switzerland, New Zealand, China, Canada, Australia, Morocco, England, Lebanon, and elsewhere.

Monday, August 11, 2008

Olympics Facebook Application

Olympic Games 2008 is a fun way to track medal standings by country,

rank, or event. And though we don't have high usage numbers yet, this project has taught me a lot about the opportunities and challenges surrounding the promotion of a Facebook application. I've put links on content-sharing sites like Digg and Reddit, posted on group forums like Yahoo groups and Tribe, and mentioned it on StumbleUpon. So far, my best luck has come directly from Facebook, where friends and friends-of-friends have helped our little sports app take off.

rank, or event. And though we don't have high usage numbers yet, this project has taught me a lot about the opportunities and challenges surrounding the promotion of a Facebook application. I've put links on content-sharing sites like Digg and Reddit, posted on group forums like Yahoo groups and Tribe, and mentioned it on StumbleUpon. So far, my best luck has come directly from Facebook, where friends and friends-of-friends have helped our little sports app take off.

The best part of this experiment has been what I've learned about running a project that unfolds in real time. If Uzbekistan gets a medal and we don't have a flag ready for that country, or there's a tie for bronze, we need to adapt quickly or lose viewers.

The hardest part of this project has been entering in stats for each event. Was there a way to automate this? Next time I'm looking for an open source data feed.

Tuesday, July 8, 2008

Sports Terminology

Activation – The act of leveraging sponsorship to augment the impact on the target audience. For example, during Visa's recent sponsorship of the Olympic Games they spent $3 to $4 on marketing for every dollar spent on acquiring sponsorship rights (not including media buy).

Affiliation in Sponsorship – Consumers define themselves in part by their memberships and affiliations to various social groups, so highly identified fans see themselves as "members" of the team and act in ways to support the team. (The fourth mechanism of influence in sports sponsorship.) (Pracejus, 2004)

Ambush Marketing – A marketing campaign by an organization with the goal of associating themselves indirectly with a sports event in order to gain the recognition and benefits associated with being an official sponsor (Sandler & Shani, 1989). An example of ambush marketing took place in the 2000 Sydney Olympics when Qantas Airlines used the slogan, "The Spirit of Australia" in imitation of the games’ slogan "Share the Spirit," despite Ansett Air being the official sponsor.

BIRGing – Basking In Reflected Glory. When a fan takes credit for a team’s success.Blasting – A defensive mechanism similar to CORFing wherein a fan will attribute negative characteristics to the opposition. For example, after a loss to the Pistons, a Blazer’s fan might say, “The Pistons are from dilapidated Detroit, whereas the Blazers (and I) are from progressive Portland.”

Branding – The effort of distinguishing one product or service from a competitor’s product or service. Factors of branding include Brand Awareness (getting customers to recognize your sport product), Brand Image (building a customer’s belief in the product), Brand Equity (the value the brand adds), and Brand Loyalty (consistent preference of a brand).Communication Communities in Sports – A segmentation of those who watch sports. The three Communication Communities proposed by Shoham & Kahle (1996) breaks the market into three groups:

- Those who watch live sporting events (spectators)

- Those who watch sports on TV (viewers)

- Those who read about sports (readers)

Consumption Communities in Sports – A segmentation of those who participate in sports. The three consumption communities proposed by Shoham & Kahle (1996) breaks the market into three groups:

- Those who participate in competitive sports

- Those who participate in fitness sports

- Those who participate in nature sports

CORFing – Cutting Off Respective Failure. When a fan distances himself from his team’s failure or loss.

Endorsement – The use of a (sports) celebrity’s name, likeness, or autograph in connection with the sale or promotion of a product or service. Fans might chose to buy the product in order to emulate the celebrity, in what is sometimes called “image transfer.” (Gardiner, 2006)

Event Management – The planning, organization, delivering, and management of an event. Typical tasks include management of ticket sales, sponsors, performers, permits, promotions, and budgets.Experiential Consumption – When the consumer takes on an active role in the production and delivery of the consumption experience. Sports spectators are often active in their consumption of their experience, such as those who feel drained after watching a game or match. (Morgan & Summers, 2005)

Extreme Sports – Also called “Adrenaline Sports,” “Action Sports,” and “Adventure Sports,” these are sports with a perceived level of danger that often focus on performing tricks or stunts, and which are geared toward the individual rather than a team. The adherents of Extreme Sports are perceived to reject traditional marketing approaches. The X Games and Gravity Games are both examples of multi-sport events that feature extreme sports.Fan Equity – What a fan believes he deserves for his loyalty. Also, the emotional bond that links a fan to a team. (McDonald & Milne, 1999)

Image Transfer in Sponsorship – The abstract beliefs about a property that transfer to a sponsor. An example of this is when a consumer feels that the personality of a brand takes on the personality of a property—as in Ironman watches (brand) taking on the toughness of an Olympic decathlon (property). Moderating variables include degree of similarity, level of sponsorship, event frequency, and product involvement. (The third mechanism of influence in sports sponsorship.) (Pracejus, 2004)

Implied Endorsement in Sponsorship – This mechanism requires the consumer to infer that the property is somehow endorsing the brand. Athletes are a primary example of this, as in: "If Greg Oden is wearing those shoes then I'll jump higher if I wear them too." (The sixth mechanism of influence in sports sponsorship.) (Pracejus, 2004)

Implied Size in Sponsorship – The perceived size of an event selected for sponsorship is a signal of the company's financial strength. Implied size acts as a heuristic (mental shortcut) similar to "price equals quality." (The fifth mechanism of influence in sports sponsorship.) (Pracejus, 2004)Licensing – The method of exploiting intellectual property by transferring the rights of use to a third party without the transfer of ownership. In sports this often means the use of a logo or trademark on merchandise, such as the use of a team-specific logo on a credit card.

Marketing Sports – Marketing a sports good or service directly to sports consumers. Selling tickets is a prime example of this.

Marketing Through Sports – Using a sports affiliation to market non-sport goods and services. Selling stadium naming rights is an example of this kind of marketing, and should not be confused with licensing.

Narrowcasting – Media messages directed at specific segments of the population defined by values, preferences, or demographics. Sports marketing strategists attempt to distinguish and separate the large groups of consumers that are brought together through sports.Olympic Effect, The – An economic boom that affects the hosting city and country of the Olympic games. Examples of this include increased housing prices in London years before the 2012 games, and the creation of jobs brought on by the Beijing 2008 Olympics.

Parasitism in Sports – The act of taking advantage of another’s representation without authorization. For example, in 1977 the state of Delaware created a lottery based on the results of NFL games without permission from the league. (Moorman & Greenwell, 2005)

Primary Sports Roles – Those who participate in sports. (See Consumption Communities in Sports.) This is also called “direct involvement.”

Reciprocity in Sponsorship – The message of reciprocity is that the sponsor supports an event an individual consumer cares about, so the consumer will go out of his way to support the sponsor by purchasing the sponsor's product. (The seventh mechanism of influence in sports sponsorship.) (Pracejus, 2004)Relatedness in Sponsorship – The closer the relationship between properties and sponsoring companies, the easier it is for consumers to recall the sponsoring company's brand. For example, it is easier to remember that Speedo sponsored Olympic swimming than it would be to remember Coca Cola's sponsorship of the same property. (Pracejus, 2004)

Secondary Sports Roles – Those who act as listeners, readers, spectators, or viewers of sports. (See Communication Communities in Sports.) This is also called “indirect involvement.”Seven Mechanisms of Influence in Sports Sponsorship – The seven mechanisms through which sponsorship can influence consumers. Proposed by John W. Pracejus, the mechanisms that sponsorship influences brand equity and brand positioning are, in order of cognitive elaboration needed: Simple Awareness, Affect Transfer, Image Transfer, Affiliation, Implied Size, Implied Endorsement, and Reciprocity. (Pracejus, 2004)

Simple Awareness in Sponsorship – The awareness of a brand's existence, or initial exposure to a brand. (The first mechanism of influence in sports sponsorship.) (Pracejus, 2004)Sponsorship – A deal under which a sponsor pays a sport entity (athlete, event, league, or team) to promote the sponsor’s product or organization. The sport entity also often delivers advertising space and some level of exclusivity. (Andreff & Szymanski, 2006)

Sponsorship Recall – The recognition of a company's role as a sponsor. In a practical application: a non-leading brand must be prepared to spend more money than a leading brand to achieve high sponsorship recall. (Pracejus, 2004)

Works CitedAndreff, W. & Szymanski, S. “Sponsorship, in Handbook on the Economics of Sport.” Edward Elgar Publishing, 2006. p 49.

Gardiner, S. “Sports Law.” Routledge Cavendish, 2006. p 433.McDonald, M.A. & Milne, G.A. “Cases in Sports Marketing.” Jones & Bartlett Publishers, 1999. p 6.

Moorman, A. M. & Greenwell, T. C. “An examination of consumer perceptions of ambush marketing practices.” Journal of Legal Aspects of Sport, 2005. p 191.Morgan, M..J.J & Summers, J. “Sports Marketing.” Thomson Learning Nelson, 2005. p 16.

Sandler, D.M. & Shani, D. “Olympic Sponsorship vs. ‘Ambush’ Marketing: who gets the Gold.” Journal of Advertising Research, August/September 1989, Cambridge University Press. p 9.Pracejus, J. Edited by Kahle, L.R. & Riley, C. “Sports Marketing and the Psychology of Marketing Communication.” Lawrence Erlbaum Associates, 2004. p 175-186.

Works Consulted

Kobel, P. “International Report on Question B : Ambush Marketing Too Smart to Be Good ? Should Certain Ambush Marketing Practices Be Declared Illegal and If Yes, Which Ones and Under What Conditions?” International League of Competition Law. Accessed January 3, 2008.

Tuesday, June 3, 2008

The Top-Paid US athletes

Sports Illustrated released its annual listing of top-paid athletes today. For some, the findings are no surprise. For example, Tiger Woods holds on to the top spot, raking in more money than Phil Mickelson, LeBron James, and Floyd Mayweather Jr (ranked second, third, and fourth) combined. Also, NBA players made up 26 of the top earners (counting Amaré Stoudemire who was mistakenly listed as a baseball player).

Sports Illustrated released its annual listing of top-paid athletes today. For some, the findings are no surprise. For example, Tiger Woods holds on to the top spot, raking in more money than Phil Mickelson, LeBron James, and Floyd Mayweather Jr (ranked second, third, and fourth) combined. Also, NBA players made up 26 of the top earners (counting Amaré Stoudemire who was mistakenly listed as a baseball player).However, the data leads to some interesting findings. Here are three observations:

The above numbers seem to show that the business of sports has lost some of its racial baggage, since endorsements and salaries are higher for non-Caucasian athletes. But that’s not the whole story. If we start with the premise that salaries are a good indication of a player’s worth to a team, at least within his league (and I use “his” because a woman hasn’t yet broken the top 50 mark for earnings), then it should follow that the more talented athletes should rake in the greater share of endorsement dollars. But a closer look at the numbers shows that Caucasian and light-skinned athletes make more sponsorship money as a ratio of their salaries than non-Caucasians. Just look at the chart.

The ratio here is endorsements/salary, so a higher ratio indicates a greater amount of endorsement money over salary money. What we see is that, on average, a greater percentage of the Caucasian group’s total earnings come from endorsements. For an example of this, take two NBA players: Jason Kidd (white) and Jermaine O'Neal (black). Both make an identical salary, yet Kidd pulls in exactly twice as much money in endorsements.

Fifty data points is still a relatively small sample size, and the salary indicators point to an equal playing field, but these numbers should be a reminder to sponsors who use athletes in their marketing that the disparities that David Falk bemoaned may not have disappeared.

Sunday, May 18, 2008

Negotiation Tips from a Sports Agent

Last week I sat down with a sports agent who represents top-level players from the NFL, NBA and MLB. In the midst of our conversation, he shared some outstanding tips on how to score big for a client, while also maintaining the personal relationships with leagues and owners that buttress his reputation.

Last week I sat down with a sports agent who represents top-level players from the NFL, NBA and MLB. In the midst of our conversation, he shared some outstanding tips on how to score big for a client, while also maintaining the personal relationships with leagues and owners that buttress his reputation.1) Be prepared. “I happen to be in a business where you can persuade people. To do it right, we out-prepare anyone.”

2) Control as many aspects of the negotiation as you can. “Sometimes it’s just me, one-on-one at dinner. Sometimes I come with multiple people, guns blazing. You have to know who you’re dealing with and leverage the situation to your advantage.”

3) Know the other side’s priorities. “Lots of times, it’s cash. If you can give a little in one area, you can almost always gain a lot in another.”

4) Use time zones to your advantage. “If we’re on the West Coast talking to guys out East, we start late, order a pizza at 7 p.m., and beat the stamina out of ‘em. On the East Coast calling West, it’s all about the early morning negotiations.”

5) Know your opponent. “For a new negotiator, I’ll get them comfortable, bring them into my office, have my dog nuzzle up.”

6) Make them feel good in the end. “Let the other side win on the last point. You can kill ‘em in the war, let ‘em win the last battle.”

Saturday, May 17, 2008

Interview with Ransu Salovaara

Q. How can sports properties benefit from the world of Web 2.0?

A. People spend significant amounts of time on sports Web sites and are therefore easy to reach with online advertising. Moreover, these interactions are totally measurable. In regards to sports, the Web has surpassed the print medium as the number one content resource. So, with Web 2.0, sports brands can create services that truly engage customers and attract them to brands. A good example of this is Nikeplus.com, which is a great way to measure and share content – specifically running information.

Q. What do you think will be the most significant change in sports advertising in 2008? In the next 5 years?

A. I see three major changes:

1. Print will die. Already we’re seeing a decline in youth magazines, like those aimed at snowboarders and skiers. Young guys don’t see a reason to buy magazines anymore since the Web is full of info, videos, and other content that appeals to them. I’m sure that outdoor, golf and running titles will soon follow as the active adult generation really picks up on the Internet as a place for news, tips and community.

2. Videos on the Web will grow substantially in coming years and advertisers will find ways to get their messages in.

3. Mobile advertising will take off. This still might be a couple years away, but mobile ads are definitely coming. Now that iPhone has opened its platform to developers, it’s easy to see how resort guides, how-to tips, etc. will work on mobile phones.

Q. What niche sports audiences are the most difficult for advertisers to reach? Why?

A. There are really no hard ones, since everyone is on the Web nowadays. However, high net-worth golfers are probably the toughest as these professionals don’t surf around the “cool” Web sites like snowboarders do.

Q. In terms of originality and cutting-edge content, what do you think are the top sports Web sites in Europe and the US?

A. Pinkbike.com is a great example of a cool niche site that caters to free-ride mountain bikers and has 40 million page views and 400,000 unique visitors every month. Every day people upload more than 1,000 mountain biking pictures to the service. Pinkbike is from Canada but it has a global audience as is one of the most popular sports sites some European countries.

Another great site is Newschoolers.com, a freesskiing site from California. The site has more than 100,000 registered users and is considered the Facebook of skiers.

(Mr. Salovaara’s responses have been edited for clarity.)

Friday, April 25, 2008

Top Sports Sites

ESPN Sportszone is ranked highest in this category, at 19th overall, while NBA.com and Foxsports.com trail at 43rd and 92nd respectively. In China, an important emerging market for many sports properties, NBA.com is the highest-ranked sports site at 71st place. In several European countries, Eurosport has top honors.

Thursday, March 27, 2008

Hulu Hoops (and more)

Hulu just added its first sports content this week, with content from the NBA and the NHL. Sure, the pickings are slim right now (there are only two NBA games up, they’re both months old, and they’re both Lakers games) but the site is just getting off the ground. The potential for this to be a sports hot spot is there.

Hulu now offers these sports features, free to everyone:

NBA

- 2 full-length games (including Kobe Bryant’s 81-point game)

- Daily Recaps

- Highlight reel: NBA 5-star plays

- Top 10 highlights

NHL

- NHL Best of The Week - Season 2007-08 (highlights the week's best assists, goals, saves, and hits)

- NHL Classics

- NHL Player Profiles 2007-08

- NHL Regular Season 2007-08

Action Sports

- Firsthand

- The 808 from Fuel TV

College Football

- The Boise State-Oklahoma battle in the 2007 Tostitos Fiesta Bowl

There’s no doubt that by the next time I log into Hulu there will be significantly more content. The real question is how NBC, Fox and their partners will transition these sports events from TV to online distribution. The current advertising model relies on short commercial breaks (with ads from Intel, Priceline, Direct TV etc), banner ads, overlays (promotional graphics that roll over the bottom of the screen) and maybe extra sponsorship dollars from events sponsors. Some games also offer a choice to viewers: to watch the game with commercials, or watch a two-minute advertisement at the beginning. (The Wizards/Lakers game is currently being shown with a preview for “Baby Mama.”)

The main obstacle for Hulu, going forward, will be whether it can attract other major content providers like CBS and ESPN. If Hulu can expand its broadcasting capabilities then it will be bigger than YouTube, bigger than social networking, maybe bigger than Google.

Notes:

NBC Sports broadcasts the Olympic Games (through 2012), the NFL, the NHL, Notre Dame Football, the PGA Tour, the USGA Championships, Wimbledon, the French Open, RCA Tennis Championships, the Dew Action Sports Tour, and more.

Fox Sports has broadcast rights to NFL games, MLB (1996–present), college football's Cotton Bowl, most of the Bowl Championship Series (BCS National Championship Game, Fiesta Bowl, Orange Bowl, and Sugar Bowl), and NASCAR.

Monday, March 24, 2008

YouTube Sports Channels

Among sports properties, there is no clear winner in the battle for online video supremacy. Last month, I wrote about Nike and adidas in the online video world, but these aren’t the major sports properties on YouTube. On the contrary, while the Nike Soccer channel boasts 286,000 views and adidas “It Takes 5ive” channel can claim 413,000 views, the NBA channel on YouTube leads the pack with 2.7 million views.

I’ve created a chart with a sampling of sports properties and their respective rankings on YouTube. Some sports properties have no official presence on YouTube, such as Major League Baseball and NASCAR, while some (like the NFL) have made a disappointing effort.

A YouTube channel is a centralized location where other users can see a user’s videos, favorites, bulletins, comments, subscribers and video log. In the case of these sports properties, a YouTube channel is similar to a Web site or a social networking profile page. The sports properties use these landing pages to direct viewers back to their official homepages (“Visit NBA.com for over 15,000 videos”) and to help promote a campaign (“Help decide which NFL player story should be made into a Super Bowl commercial”).

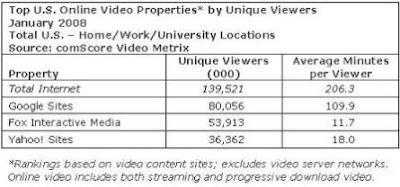

And while the skeptic might point out that none of the 2008 Super Bowl ads pointed to their social media presences on YouTube, the number of Americans viewing online video is encouraging (research indicates that 78.5 million viewers watched 3.25 billion videos on YouTube.com in January). In a market where grabbing a consumer’s attention seems ever more difficult, these numbers are worth a second look.

Thursday, March 13, 2008

Economics of the Final Four

March Madness is starting soon, with Conference Championships ending on Saturday and Selection Sunday coming the day after. The post-season NCAA tournament is good news for fans, great news for the 65 teams that compete, and fantastic news for CBS. But is it a good deal for the host cities of the Final Four?

The answer seems like it would be an emphatic “Yes,” but in the book The Economics of Sports (2004), Robert Baade and Victor Matheson argue that promoters overstate the economic benefits of the Big Dance. Accordingly, they maintain that in only two of the 48 men’s and women’s tournament finals before 2004 did the host city experience significant positive income growth.

In the separate Handbook on the Economics of Sports (2006), Baade again argues that the NCAA Tournament (along with other “mega-events” such as the Olympics, World Cup, Super Bowl, etc.) fails to generate the expected income because of costly government subsidies (such as stadium financing and infrastructure), security expenses, operating costs, and the likelihood that a counterbalance to the gross spending of visitors occurs when residents not attending the event decrease spending because of local price increases and their desire to avoid venue congestion. On top of that, multiplier analysis can be used to estimate the amount of money retained locally. In Economics of Sport and Recreation (2000)Chris Gratton and Peter Taylor estimate that only 20 percent of a

dditional visitor expenditure is retained as additional local income.

dditional visitor expenditure is retained as additional local income.On the flip side, it’s easy to see why cities line up to host the Final Four. Besides the public relations benefits and the opportunity to attract visitors who may be coming to the city for the first time, host cities also make real money. In 2006, Indianapolis hosted the Final Four and reported an economic impact of $40 million, not including direct spending from media or corporate sponsors.

Maybe this year San Antonio, the host of the 2008 Final Four, will strike it rich. But my guess is that when the dust settles and they’re counting media and visitor spending revenues, it might be harder than they think to balance their checkbook.

Friday, March 7, 2008

Nike Marketing Campaigns

Nike has had some very forgettable marketing campaigns. In a year or two, who will remember the “Free” campaign in which Nike urges athletes to train like they were wearing no shoes? Or the “Second Coming: Our Game. Our Time.” campaign that celebrates the 25th anniversary of Nike Air Force 1? Though they might be successful, they won’t last in the public imagination in the way that some of Nike’s most beloved branding accomplishments have.

But unlike these comparative flops, I think it’s fair to say that Nike, more than any other brand, has created marketing campaigns that have emblazoned themselves into our memories, and have changed the way we look at sports and maybe even ourselves.

Too corny? I challenge anyone to find marketing efforts from any industry that have made as much of an impression as the JUST DO IT and LIVESTRONG campaigns.

The slogan “Just Do It” combines grit and determination with a touch of humor. It’s a rallying cry to get off the couch. It’s self-empowering. And, according to the book, Nike Culture: The Sign of the Swoosh, the slogan shows that no matter who you are, no matter what your physical, economic or social limitations, “transcendence is not just possible: it’s waiting to be called forth.”

Lance Armstrong’s “Livestrong” movement, run in association with Nike, is similarly empowering. For a dollar, people wanting to support the fight against cancer could purchase a yellow “baller band.” By 2005, a year after the loopy wristbands were released, they had sold 42 million, making it one of the most successful cause-related marketing campaigns ever. According to the book, Why We Talk: The Truth Behind Word-of-Mouth, Nike succeeded with this campaign by focusing on customers’ higher-level needs. The “Livestrong” bracelet helped a tribe of loyalists identify themselves and with each other.

These are just two out of many Nike marketing endeavors. Below I’ve assembled a partial list of the others (most done by the Weiden + Kennedy ad agency) along with the year the campaign began.

Air Jordan – 1985

Revolution – 1987

Just Do It – 1988

Bo Knows –1989

Instant Karma – 1992

I Am Not a Role Model – 1993

Let Me Play – 1995

Whatever – 2000

Secret Tournament – 2002

Livestrong – 2004

Free – 2005

Joga Bonito ("play beautiful") – 2006

Second Coming: Our Game. Our Time. – 2007

Quick is Deadly – 2007

Become Legendary – 2008

Tuesday, March 4, 2008

Virtual Ads

Virtual ads are nothing new: the patent dates back to 1993 and the technology really took off in 2002, about the same time that virtual first-down lines started showing up in NFL broadcasts. But where midfield soccer ads, corporate logos behind home plate, and branded first-down lines are all examples of completely virtual advertising,

It will be interesting to see how this technology is received. In the 2001 World Series virtual ads were criticized as obviously fake and obnoxiously big, while today they are a fully-integrated part of the event.

Friday, February 29, 2008

Portland Sporting Goods & Apparel

End Outdoor Inc., sustainable footwear

Icebreaker, outdoor sports apparel

Keen Inc., footwear

Le Coq Sportif, sporting goods and apparel

Li Ning Sports USA Inc., footwear and apparel

Lucy Activewear, women’s sports apparel and accessories

Montrail, footwear

Nau, inc., outdoor apparel

Nautilus, Inc., exercise equipment

Rapha Racing Ltd., cycling apparel

Solstice Outdoor Inc., outdoor gear

Wednesday, February 27, 2008

Online Video Marketing Campaigns

In the last year, sport marketers seem to have boosted their online presences with fancier Web sites, integrated Flash applications, Social Networking profiles, and more. But of all the improvements these companies have made online, perhaps the most effective (after a Web site) has been the use of innovative video techniques.

One of the best videos, shot with an amateur camera, features the Brazilian soccer star, Ronaldinho, as he meticulously straps on a pair of Nike soccer shoes, juggles the ball for a minute, then fires four consecutive shots off the top of the goal post without letting the ball touch the ground. The video, posted by Nikesoccer.com, has been viewed more than 21 million times as of this posting. To put that in perspective, this is roughly a quarter of the global viewership of an average Superbowl. Not bad when you consider that the clip is 2 minutes and 44 seconds, and that viewers were likely paying more attention to the video they had chosen to see than they would to a Superbowl commercial.

With the majority of online video viewers saying that they find new videos through friends’ recommendations, it’s helpful to note that the Ronaldinho video was selected as a favorite (“favorited”) by 48,740 different viewers. Youtube, like other social participation sites, allows users to tag, comment, rate, and embed the videos as well as add them to a favorites list. In the near future participants should also expect to be able to personalize, edit, an add in-video comments.

“It Takes 5ive” is the adidas basketball campaign based on the idea of believing in the team. The campaign has put together a presence on YouTube with clips of Dwight Howard, Jerry Stackhouse, Adam Morrison, TJ Ford, and other celebrity ball players. Their most viewed clip, “adidas 5ive on 5ive,” has just over a million views, and is part of a campaign that includes at least 14 other short videos. Though not as successful as the Nike soccer video campaign, adidas finishes the video with a call to action, urging viewers to see all the action by visiting their video site. Adidas’ video is a jumping off place for the basketball enthusiast to see more related videos and the accompanying marketing messages.

Digital marketing can help maximize the impact of production budgets (the Ronaldinho video would have cost more than $10M to air on the Superbowl because of its length), it can act as a gateway to a longer piece that allows for a deeper and more interactive experience, and it can work without the formal constraints of time (both in the sense of 30 second spots and the sense of ads appearing only after the 5 o’clock news). Digital marketing doesn’t mean that traditional marketing is irrelevant, but it has become enough of a force that media campaigns should have an Internet component. Moreover, traditional media should take a lesson from the 2007 Doritos “Crash the Super Bowl” contest and learn how to integrate this new format with their own.

Monday, February 25, 2008

Samsung's Sponsorship Deal

The market researchers at TNS Global—a leading sports research company that provides information to over 300 sponsors—just released a case study confirming the sponsorship benefits for the Samsung Mobile brand in its pairing with the Chelsea Football Club. The full report is available here, but I’ve extrapolated some key points of interest:

Of course the report doesn't comment on what Samsung paid for the sponsorship rights, but chances are they’re pretty happy. Chelsea FC’s support in London at the end of 2006 was nearly double what it was three years previously, and Chelsea is currently ranked third in the Premier League. On top of that, the cost of the 13.33 minutes of TV advertising might cost Samsung over a million dollars per game, were the company to pay for it 30 seconds at a time. (Calculated at $50,000 per 30 seconds, plus $350,000 initial production costs. In the US, TV ads could be 3 to 10 times that cost.) And that’s not even taking into account the 100 print photos/month, the value of which depends mostly on placement and circulation.

Thursday, February 21, 2008

Sports Marketing in Second Life

adidas AG

For $50 Linden Dollars (L$50—roughly $0.20) you can outfit your avatar with a3 Microride shoes from the adidas store, which allow the wearer to bounce around like a kid on a pogo stick. The shoes may not have permeated the Second Life market like adidas once hoped, but the move to open a retail outlet got some positive press back in 2006 and may have also made Second Lifers feel like an important demographic.Reebok

Direct your avatar over to the Reebok island on Second Life and you’re in for a marketing treat. Unlike at the adidas Sim, at the Reebok store you can buy shoes AND customize them. Shell out L$50 for the initial white pair and before you know it you’ll be upgrading to a custom-color pair for only L$5 more. You can come back as often as you want to switch the color, and the cost is L$5 each time.

Major League Baseball

In July of 2006 Major League Baseball simulcasted its popular Home Run Derby on Second Life. Fans and their avatars paid L$1000 (about $3) to congregate at the virtual stadium on “Baseball Island” and watch the event on virtual screens. The event was criticized for adding very little interactivity to the experience, though the MLB marketing executives did set up chat rooms for fans to trash talk, and sold virtual MLB merchandise at the event and at in-world stores.

NBA

If the Major League Baseball foray into Second Life is a rim shot, then the NBA’s presence is a slam dunk. At the NBA headquarters that opened there in June 2007, sports-minded avatars can watch 3-D diagrams of games in real time while chatting with others, play HORSE and Crash The Boards at the NBA Jam Session area where basketballs are freely available, and buy NBA merchandise. Like the Reebok store, this virtual world is likely to attract repeat visitors.

games in real time while chatting with others, play HORSE and Crash The Boards at the NBA Jam Session area where basketballs are freely available, and buy NBA merchandise. Like the Reebok store, this virtual world is likely to attract repeat visitors.One of the detractors to sports properties focusing their attention on Second Life is that some of the recent media has highlighted the adult nature of the virtual world. For a family-friendly brand like Major League Baseball, association with Second Life has its drawbacks. Just consider the recent articles decrying inappropriate behavior, FBI investigations, sexual harassment, and pornography. So while some sports properties are excited to be among the first in the industry to brand themselves in these virtual worlds, others are understandably worried.

Monday, February 18, 2008

Facebook Applications

Sports marketers use the popular networking site, Facebook, to promote events, market leagues, advertise media outlets, and generate excitement about sports properties. And while not all sports entities have created a presence on Facebook, those that have can claim real results for a minimal investment.

CBSSports.com has recently created the Official Tournament Brackets application. Roughly 500,000 users have uploaded this app, and most days nearly 5,000 of those users open the application to play around with it. This particular application lets users create a NCAA basketball tournament bracket, register themselves as fans of particular teams, and compare brackets against friends and other users for a chance to win $10,000.

Sports Illustrated has created a more modest application with roughly 10% as many users as the CBS sports app, which allows the user to choose favorite teams from the “Big Four” leagues plus NCAA basketball and football. It then spits out customized SI headlines for those teams.

A third, less-known company, Citizen Sports Network, has created dozens (possibly hundreds) of Facebook applications targeted uniquely to fans. Each page is a forum for fans of a team to congregate, discuss, and cheer with fellow supporters. Citizen Sports Network has highly-downloaded and viewed applications, with names like “Red Sox Nation” and “England Football.”

Many sports properties, such as Nike, haven’t necessarily created their own Facebook applications, yet still maintain a Facebook presence. A search for Nike applications, for example, yields a “Nike+ Running Monitor” app that lets users share Nike+ running progress with friends, and a few other applications designed independently from the company. Searches for “adidas” and “nfl” yield similar results.

Other sports properties have reserved the use of their name in the same way that someone might buy a domain name for future use. The difference with Facebook is that application names are free and must be at least 7 characters (thus “nike” would be unacceptable, but “niketennis” would work). Callaway Golf has reserved their name without actually creating an application, as have EA Sports and adidas. However, some companies have clearly failed to reserve the use of their names, as “IMGWorld” and “Daktronics” are still available for anyone to snatch up.

I reserved the use of some excellent application names that might someday have value just as domain names in the early 21st century came to be valuable. Perhaps years from now “icehockey,” “softball,” and “wrestling” will all be worth hundreds or even thousands of dollars. And even if these names aren’t worth anything, it seems prudent for any corporation to grab up their own name. I just registered “NorthFace” and it didn’t cost me a penny.

Friday, February 15, 2008

Accepted to the UO Sports Marketing MBA program

Today I was accepted to the University of Oregon Warsaw Sports Marketing Center’s MBA program, class of 2010. The Sports Marketing program at the U of O places graduates in sports leagues, sports franchises, sports media, and sports products companies. Nike hires more UO MBA graduates than any other company, and more UO MBAs intern at Nike than at any other company. Other top firms to hire UO Sports Marketing MBA graduates include adidas North America, the NBA, the WNBA, the NFL, Visa, Octagon, Wieden + Kennedy, Columbia Sportswear, and many more.

Sunday, February 3, 2008

Warsaw Guest Speakers

The sports marketing program at the University of Oregon had a strong group of guest speakers this winter. Below is a list of the industry professionals who recently shared their insights with students. Source: Lundquist College of Business biannual magazine, Business. (Volume 5, Number 11, Winter 2008)

Rick Alessandri, ESPN

Grant Armbruster, Columbia Sportswear Company

Marc Badain, Oakland Raiders

David Baker, Arena Football League

Scott Bedbury, Brandstream

Jeff Benjamin, Printroom.com

Malcolm Bordelon, San Jose Sharks

Renee Brown, WNBA

Carter Carnegie, National Thoroughbred Racing Association

Arjun Chowdri, Genesco, Inc

Michelle Collins, IMG

Ron Coverson, Stanford Athletics

Bob Cramer, Genesco, Inc

Jarrod Dillon, Oakland Raiders

Andy Dolich, Memphis Grizzlies

Kelly Dredge, IMG

Jarrett Dube, ESPN Andrew Fink, NFL

Evan Frankel, NASCAR, Inc.

Tom Fritz, Marmot Mountain, LLC

Mary Pat Gillin, NBA

David Haney, Arena Football League

Chris Heck, NBA

Stephanie Heidrich, Columbia Sportswear Company

Mike Herst, Electronic Arts, Inc.

Calen Higgins, Columbia Sportswear Company

Heather Higgins, National Thoroughbred Racing Association

Gregory C. Houser, Marmot Mountain, LLC

Stu Jackson, NBA

Akash Jain, NBA

Brian Jennings, NHL

Ilana Kloss, World Team Tennis

Katie Lacey, ESPN

Amy Lasky, National Thoroughbred Racing Association

Michael Leming, Nike, Inc.

Dana Lent, NASCAR, Inc.

Hunter Lochmann, New York Knicks

Mike Lopono, Arena Football League

Marc, Lowitz, Arena Football League

Julie Malmberg, Nike, Inc.

Mark Martin, Marmot Mountain, LLC

Donovan Mattole, Nautilus, Inc.

Chris McCloskey, Arena Football League

Tom McDonald, San Francisco Giants

David Murrell, Columbia Sportswear Company

Darrin Nelson, Stanford Athletics

Kim Nelson, Nike, Inc.

Jim Noel, ESPN

Jolynn Ovington, nau inc.

Steve Patterson, Portland Trailblazers

Andi Poch, WNBA

Jeff Price, Sports Illustrated

Craig Purcell, Oakland Raiders

Dan Reed, NBA

Andrew Rentmeester, Oakland Raiders

Michael Rooney, ESPN

Peter Rotondo, Jr., National Thoroughbred Racing Association

Peter Rotondo, Sr., National Thoroughbred Racing Association

Robert Rowell, Golden State Warriors

Jennifer Rowland, Visa International

Norris Scott, NASCAR, Inc.

Adam Silver, NBA

David Stern, NBA

Jimmy Su, NBA

Aaron Taylor, ESPN Bob Thompson, Fox Sports

Gary Treagen, Electronic Arts Inc.

Donna Tripiano, IMG

Jeff Tucker, San Francisco Giants

Jim Tucker, NASCAR, Inc.

Steve Tseng, IMG

Heidi Ueberroth, NBA

Matthieu Van Veen, NBA

Ted Van Zelst, NASCAR, Inc.

Tyler Vaught, Electronic Arts Inc.

Pamela White, National Thoroughbred Racing Association

Friday, January 18, 2008

Promotional Products Association International Expo

ooths belonging to less established exhibitors, to ask them about the challenges of marketing a sports product. The responses were varied. Some spokespeople claimed they had no difficulties because their’s was such a great product. Others didn’t see their industry as the sports industry but rather the promotional products industry—as though selling an imprinted jersey was the same as an imprinted book or coffee mug. Still, I got some honest and interesting answers, shared below.“The most challenging part is reaching the right audience. We do team sports and corporate uniforms, so the challenge is not losing each side.”

ooths belonging to less established exhibitors, to ask them about the challenges of marketing a sports product. The responses were varied. Some spokespeople claimed they had no difficulties because their’s was such a great product. Others didn’t see their industry as the sports industry but rather the promotional products industry—as though selling an imprinted jersey was the same as an imprinted book or coffee mug. Still, I got some honest and interesting answers, shared below.“The most challenging part is reaching the right audience. We do team sports and corporate uniforms, so the challenge is not losing each side.”

-Doug Massong, Augusta Sportswear

“My biggest challenge is the constant price increase in urethane foam.”

-Tom Teach, Quality Foam Designs

“We’ve needed to differentiate our product. Everybody knows about these sticks [holding up a pair of thunder sticks]. We make ours out of beach ball material so you can inflate these and reuse them.”

-Terry Brizz, Galaxy Balloons

“We sometimes have trouble with big companies because they may only have a few preferred customers. We’d like to communicate directly to them, but we can’t.”

“We sometimes have trouble with big companies because they may only have a few preferred customers. We’d like to communicate directly to them, but we can’t.”-Bob Nowak, Spalding